Step 2) Budget: Expenses and a New Life

1) Map Out Your Month-to-Month Expenses

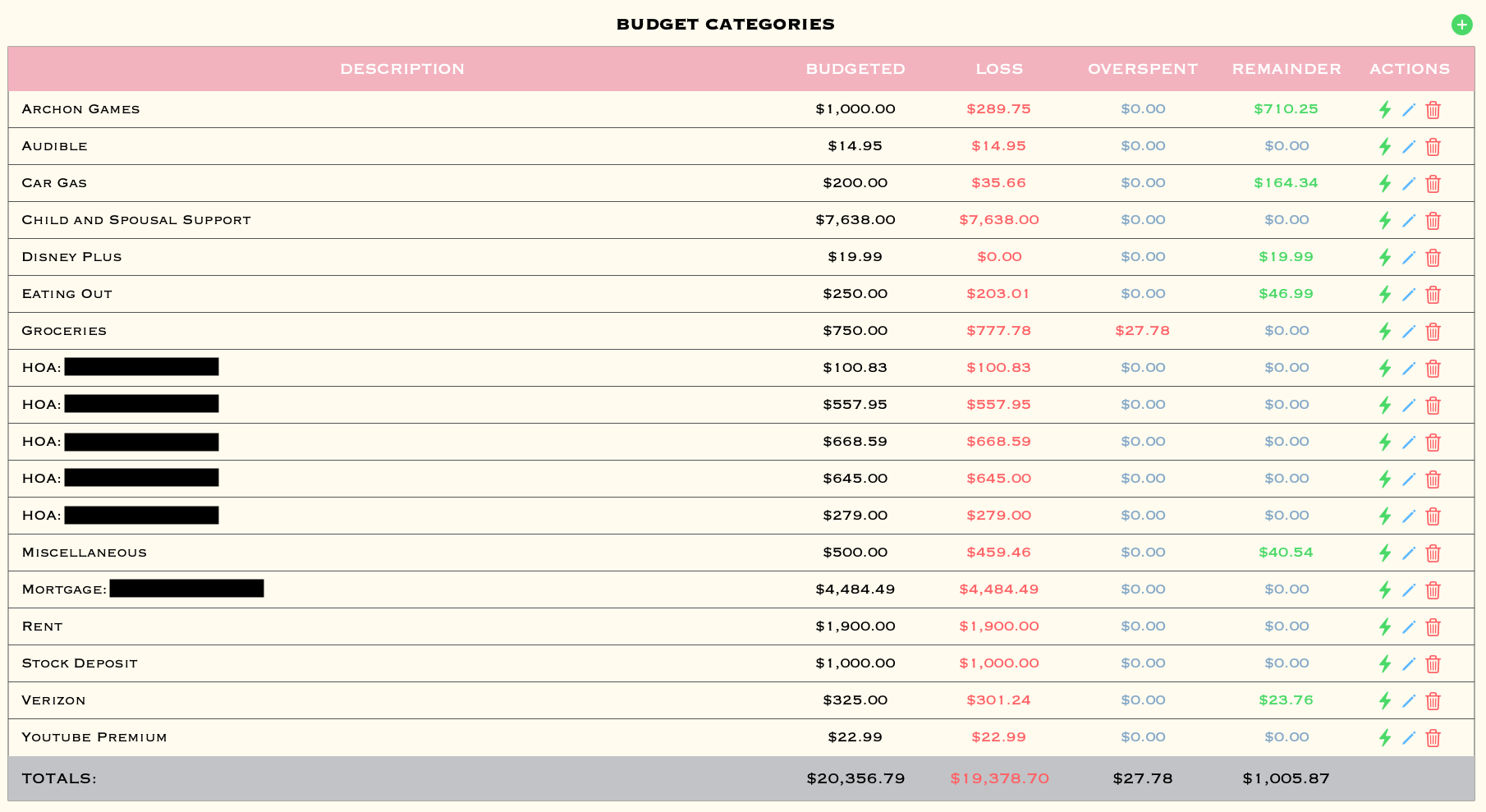

What you’re seeing above is the Budget section and month-to-month expense map I built inside my app. I’ve added budget categories and the monthly amounts for every expense I owe. It doesn’t matter if your categories match mine — this is personal to you.

You’ll notice I have several HOAs and a mortgage listed. That’s mostly because I help track my family’s properties. I’m responsible for the payments since I’m the “responsible” one with money and know how to work a computer (a good portion of my family still doesn’t 😅). I blurred out the more personal information, but you can see what I’m tracking.

These are all the known, recurring expenses I generally have. The “Miscellaneous” category is a catch-all for the unknowns that life throws at you — because there are always unknowns. They need to be accounted for.

Once you’ve mapped out all of this, you’re ready for the next step.

2) Take Out What’s NOT Needed

These are my modified expenses after recently going through and cutting out things I no longer needed.

For example, one of the categories I removed was Netflix (a savings of $33.98). I realized I only needed two streaming services instead of four. I had HBO Max, Hulu, Disney+, and Netflix, and I was paying around $120+ per month in subscriptions. I decided I didn’t need Netflix anymore because I’m the only one who really watches it — not my kids. I also downgraded the Disney+, Hulu, and HBO Max No Ads bundle ($32.99) to just Hulu and Disney+ with no ads ($19.99). Switching plans saved me $13 per month. Individually, these two changes don’t look like much, but together I’m saving just under $50 per month. That’s easily a few days’ worth of meal prep if you do it right (we’ll get there one day 🙂 — I have a lot planned for this blog).

Between the Disney+ & Hulu bundle, YouTube Premium, and Amazon Prime Video (which comes with my yearly Prime subscription), I have more than enough streaming content and that’s the PERSONAL choice I made to save 50 dollars a month.

I kept Audible because I don’t learn well by reading — I learn by listening — so that one is essential for me.

But this step is hard. It really is. It’s deeply personal, and you need to make those decisions and be okay with them. Don’t give yourself a soft excuse just so you can keep something you want when it’s not something you truly need. If you really need to get down to the bare minimum, you need a roof, utilities, and food. Depending on where you live, maybe a car. Everything else? Out the door. If your situation calls for it, you may even need to go scorched earth. Look for free things to do with your kids. Cut subscriptions. Cut convenience. Cut impulse spending.

It’s all about stripping things down as much as possible so you can rebuild stronger.

It takes real self-reflection to decide what’s essential in your life and what isn’t. For example, I don’t eat out for myself anymore. I only eat out when I take my kids to their favorite restaurants. But I’ve also learned how to make a lot of their favorite foods by the restaurants via the internet.

You have to start cutting things down to the bare minimum.

You probably won’t be happy at first.

But it will be worth it in the end.

3) Communication

Be sure to communicate with your family, spouse, or whoever you live with about the changes you’re making. I’d just be honest about it: “It’s going away for now because of the cost, and we want to afford it comfortably later.” There is NOTHING wrong with that. You’re looking out for your future self. It’s honorable to plan ahead and want a better future — to help your future self instead of just living for today and if it’s for your family that’s even better.